Question: We are settling a workers’ compensation claim with a Medicare beneficiary for $25,000 on a full, final, and complete basis closing out all future medical on the claim. $20,000 of this settlement is a Medicare Set-Aside (MSA) allocation. We previously settled out the indemnity portion of the claim for $50,000. Can we submit the MSA to Medicare for review and approval? And once we settle, what do I report via Section 111 Mandatory Insurer Reporting for the Total Payment Obligation to the Claimant (TPOC)?

Answer: Today’s question implicates Medicare Secondary Payer (MSP) compliance from two different angles: meeting the workload review threshold for participation in the voluntary MSA submission process and what to report to Medicare via the Section 111 Mandatory Insurer Reporting process. Let’s jump in.

MSA Submission

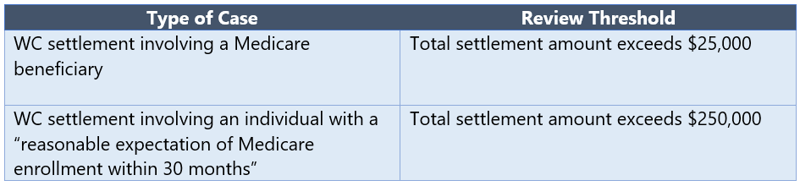

Medicare outlines its workload review criteria in Section 8.1 of the WCMSA Reference Guide and indicates it will review a proposed MSA amount when the following workload review thresholds are met:

So, does this case exceed the $25,000 review threshold for claims involving a Medicare beneficiary? The claimant will receive $25,000 exactly but there was a prior settlement. Should that prior payment of $50,000 be counted? We turn to Section 10.5.3 of the WCMSA Reference Guide to learn how to calculate the “total settlement amount” for MSA submission purposes:

“The computation of the total settlement amount includes, but is not limited to, an allocation for future prescription medications of the type normally covered by Medicare, in addition to allocations for other Medicare covered and non-covered medical expenses, indemnity (lost wages), attorney fees, set-aside amount, non-Medicare medical costs, payout totals for all annuities rather than cost or present values, settlement advances, lien payments (including repayment of Medicare conditional payments), amounts forgiven by the carrier, prior settlements of the same claim, and liability settlement amounts on the same WC claim (unless apportioned by a court on the merits).“

Given that information, we need to include the prior settlement of indemnity benefits when calculating the total settlement value here. So the total settlement value in the fact pattern outlined by our questioner is $75,000 ($25,000 + $50,000). Thus, the $20,000 MSA may be submitted to Medicare for review and approval since the total settlement value exceeds the $25,000 workload review threshold.

Reporting the TPOC

Note that the calculation of review thresholds and the calculation of TPOC amount are separate policies that need to be independently evaluated. Whereas the “total settlement amount” for MSA review purposes includes prior settlements (including indemnity only settlements), the TPOC amount only includes one-time settlements that resolve claims for medical benefits in whole or in part. Pursuant to Section 6.4 of the NGHP User Guide Medicare defines the “total payment obligation to the claimant” or TPOC amount as follows:

“The TPOC Amount refers to the dollar amount of a settlement, judgment, award, or other payment in addition to or apart from ORM [(ongoing responsibility for medicals)]. A TPOC generally reflects a ’one-time’ or ‘lump sum’ settlement, judgment, award, or other payment intended to resolve or partially resolve a claim. It is the dollar amount of the total payment obligation to, or on behalf of the injured party in connection with the settlement, judgment, award, or other payment.”

WC carriers must report claim information to Medicare “where the injured party is a Medicare beneficiary and payments for medical care are claimed and / or released, or the settlement, judgment, award, or other payment has the effect or releasing medicals.” NGHP User Guide p. 3-2. In late 2020, Medicare updated the Section 111 User Guide to clarify that indemnity-only workers’ compensation settlements are not to be reported, so long as the employer / carrier remains responsible for ongoing medical treatment. The key language is as follows:

“In situations where the applicable workers’ compensation or no-fault law or plan requires the RRE to make regularly scheduled periodic payments, pursuant to statute, for an obligation(s) other than medical expenses, or a one-time ‘indemnity-only’ payment or settlement for obligation(s) other than medical expenses is made to or on behalf of the claimant, the RRE does not report these periodic payments or one-time settlements as long as the RRE separately assumes/continues to assume Ongoing Responsibility for Medicals (ORM) and reports this ORM appropriately.”

A TPOC consists of a one-time payment to resolve a claim for medical benefits. An indemnity only settlement is excluded from TPOC since it does not resolve a beneficiary’s claim for medical. In light of that, our questioner need only report $25,000 as the TPOC amount. The prior indemnity-only settlement is not considered a TPOC.

Unlike the analysis for the MSA submission threshold, there is no “look-back” period on TPOC. If multiple settlements completely resolve multiple injury-related components of the claim, then those multiple settlements would be reported as separate and distinct TPOCs.

Our mission here at ECS is to provide the most comprehensive, creative, and customizable compliance and reporting solutions for the marketplace. Leveraging extensive clinical and legal experience, ECS merges the scale, talent and technology of an established compliance provider with the creativity, customer service and flexibility of a boutique firm. Please reach out to your Regional Compliance Consultant with any questions related to the MSA process or to get in touch with our Section 111 Mandatory Insurer Reporting team.